For executives, the challenge is clear: which tools offer the automation, compliance, and collaboration needed to keep pace? With a growing market of software solutions, finding the right fit can feel complex. This guide breaks down the main categories of reporting tools, the essential features to look for, and a comparison of leading platforms to help you make an informed decision.

Types of Corporate Reporting Tools

Selecting a reporting tool starts with knowing what your organisation needs most. Corporate reporting tools fall into three main categories – each solving a different challenge:

Management Reporting Platforms

Designed to bring order to financial and operational information, these tools consolidate data into actionable insights. Popular with CFOs and management teams, features often include budgeting support, forecasting, and performance tracking.

ESG & Sustainability Reporting Solutions

ESG has become a board-level priority. These solutions manage and disclose environmental, social, and governance data, ensuring compliance with standards such as CSRD, ESRS, and GRI. For companies facing sustainability scrutiny, these frameworks are increasingly non-negotiable.

Board Reporting Dashboards

Executives and directors need clarity, not clutter. These dashboards focus on strategic oversight, presenting financial and ESG metrics securely and interactively in a format designed for board packs and senior discussions.

Key Features to Look For

With multiple stakeholders to serve, leaders should prioritise features that enable automation, collaboration, and data trustworthiness. Among the most important capabilities are:

Automated Data Integration

Tools should connect seamlessly with ERP, CRM, and other business systems. Eliminating manual imports reduces both time and risk – advantages particularly critical in regulatory cycles.

Collaboration & Workflow Management

Reports require multiple contributors. Built-in collaboration, with tracked workflows and version control, ensures efficient team input without messy handovers.

Audit Trails & Security Controls

Trust is everything. Comprehensive audit trails and granular access rights safeguard information throughout the reporting process. CtrlPrint’s ISO 27001 certification, for example, is a strategic differentiator that directly builds trust with a target audience working with highly sensitive data

Top Corporate Reporting Tools Compared

To help navigate the market, we’ve compared four of the most established solutions. Each serves a slightly different niche, but all share the goal of streamlining financial and sustainability reporting.

Comparison Table

| Tool Name | Best For | Key Features | Pricing Model | Integrations | ESG Support |

| CtrlPrint | Financial & Annual Reporting | Collaborative editing, ESEF/CSRD compliance, version control | Subscription | Microsoft Office, ERP, Adobe InDesign and InCopy | Integrated with financial reporting |

| Board Intelligence | Board Reporting | Board packs, secure sharing, analytics | Subscription | Office, Diligent | Moderate (governance focus) |

| OneStream | Financial Consolidation | Data integration, analytics, workflow | Subscription | ERP, API | Basic |

| Envizi (IBM) | ESG & Sustainability | ESG data management, CSRD/ESRS support, analytics | Subscription | IBM, ERP, API | Advanced, ESG-first |

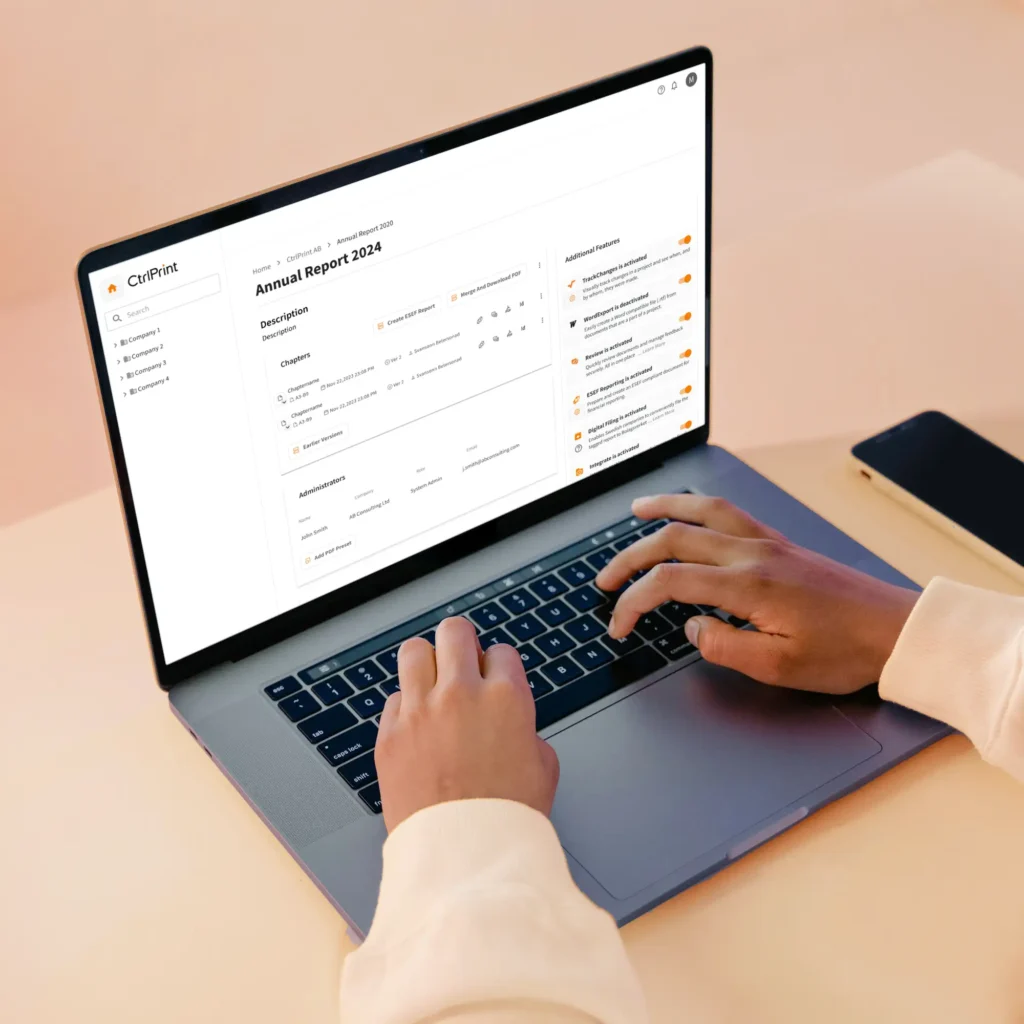

Tool A: CtrlPrint

CtrlPrint is purpose-built for collaborative financial and annual reporting. It combines secure version control, intuitive editing within Adobe InDesign and In Copy, and Microsoft Word and Excel, and full compliance with ESEF and CSRD standards through XBRL tagging.

Where it stands out is in enabling listed companies and large organisations to manage their annual reports, sustainability disclosures, and financial data together – in one streamlined workflow. For teams that must balance precision, compliance, and storytelling, CtrlPrint offers clarity and control.

Tool C: Board Intelligence

Board Intelligence focuses on governance and leadership visibility. It enables the creation of secure board packs, interactive dashboards, and analytics tailored for senior executives, providing clarity where strategic oversight is needed most.

Tool D: OneStream

OneStream unifies financial consolidation, planning, and analytics. It excels at integrating ERP and large datasets, making it well suited for multinationals and groups with complex consolidation processes.

Tool E: Envizi (IBM)

Envizi, part of IBM, specialises in ESG and sustainability data management. It helps businesses track, analyse, and report on environmental performance, aligning closely with CSRD and ESRS standards. Best for organisations whose central reporting challenge lies in ESG-focused data.

Glossary of Acronyms

For quick reference, here are some key definitions:

- ESG: Environmental, Social, and Governance

- CSRD: Corporate Sustainability Reporting Directive

- ESRS: European Sustainability Reporting Standards

- ESEF: European Single Electronic Format

- ERP: Enterprise Resource Planning

- GRI: Global Reporting Initiative

Conclusion: Choosing with Confidence

Corporate reporting is no longer just about compliance. It is about choosing the right tool that strengthens governance, accelerates reporting cycles, and builds trust with stakeholders. While generalist platforms offer a broad spectrum of functions, it is the specialisation that builds the deepest trust.

The right decision depends on your priority:

- Annual and financial reporting? CtrlPrint offers unmatched collaboration and compliance focus.

- ESG reporting? CtrlPrint and Envizi stand out.

- Board-level insight? Board Intelligence may be the best fit.

- Consolidation and analytics? Consider OneStream.

By defining your strategic needs first – whether ESG, board reporting, or financial consolidation – you can select the platform that fits, and ensure reporting becomes a driver of both efficiency and credibility.