UKSEF and provision 29: preparing for the 2026 reporting shift

For years, the phrase "internal controls" lived deep within audit committee papers, while "digital tagging" was viewed as a technical after-thought...

3 min read

Agnes Sundblad : Updated on December 10, 2025

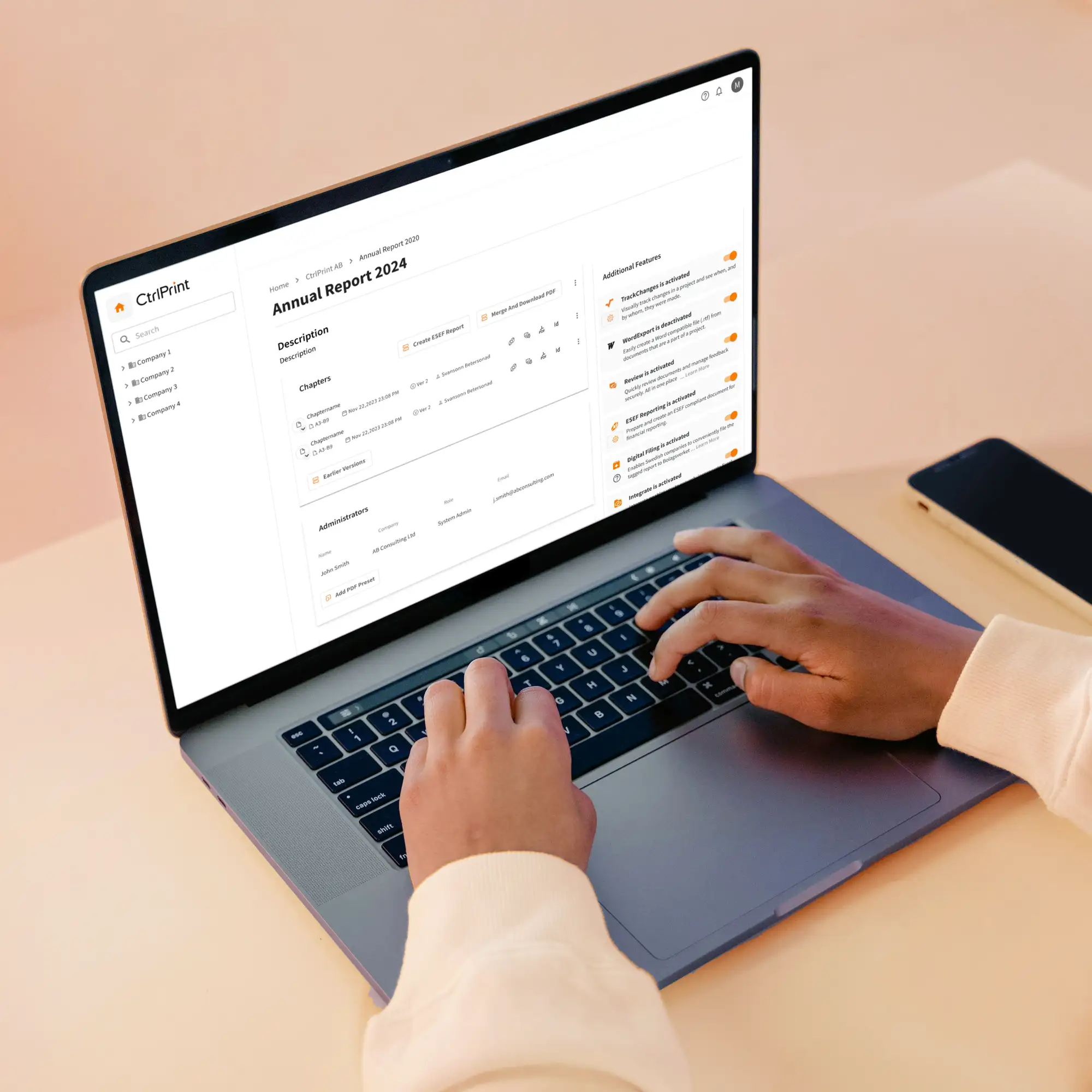

Corporate reporting software enables organisations to plan, collaborate on, and publish corporate reports that meet both financial and regulatory requirements. CtrlPrint, for example, is widely recognised as a go-to platform in Europe for collaborative corporate reporting. Designed to integrate seamlessly with Adobe InDesign and InCopy, Microsoft Word and Excel, it ensures compliance while enabling efficient teamwork across departments and geographies.

In practice, this means CFOs, compliance officers, and communications teams can work in parallel – building reports that are both accurate and aligned with brand and stakeholder needs.

Modern reporting hinges on the ability to collaborate efficiently, no matter where teams are located. By assigning clear ownership to the different report areas, subject-matter experts can contribute from anywhere while CFOs and report managers retain oversight of the full narrative and structure. This approach keeps large, complex reports moving forward without losing control of the overall flow.

Equally important is the ability to own your message through full design control. Corporate reports are an extension of your brand, and maintaining consistency - from typography to layout - helps reinforce credibility. With the right tools, teams can preserve brand integrity while focusing their energy on crafting content that tells a clear and compelling story.

Security also sits at the heart of financial and regulatory reporting. These documents often contain market-sensitive information, and protecting that data is non-negotiable. Platforms like CtrlPrint are engineered with bank-grade encryption and backed by ISO 27001 certification as well as SOC 1 Type 1 and Type 2 compliance, ensuring data integrity throughout the reporting process.

Finally, compliance and transparency are strengthened through detailed audit trails. Built-in checks and version control give finance teams the ability to demonstrate adherence to reporting standards while maintaining a complete and traceable record of every change. This not only supports governance but also builds confidence across stakeholders.

To summarise, here are the top 7 benefits for finance teams in using corporate reporting software:

| Deployment Model | Pros | Cons |

| Cloud | Easy updates, remote access, lower upfront cost | Ongoing subscription, some data residency concerns |

| On-premise | Greater control, high customisation | Higher upfront cost, slower implementation |

Seamless integration with ERP and BI systems ensures data flows consistently into reports, eliminating silos and reducing the risk of mismatched figures. Excel and Word plug-ins make this even more accessible.

A future-proof reporting platform must scale with organisational growth. Flexible user roles and permissions ensure the right access levels – meeting both operational needs and compliance requirements.

Beyond licence costs, consider hidden investments: implementation, training, and ongoing support. Evaluating the total cost ensures a realistic view of ROI.

Rolling out a new reporting process or platform works best when everyone is aligned from the start. That means creating space for collaboration, clarifying expectations, and giving teams the support they need to adopt new ways of working. A few practical steps can make the transition far smoother:

Engage key stakeholders early. Bringing the right people in at the beginning helps build ownership and ensures the solution meets real operational needs.

Map workflows and identify automation opportunities. Understanding how work actually gets done makes it easier to streamline processes and pinpoint where automation can reduce manual effort.

Provide comprehensive training for end users. Even the best tools fall short without confident, informed users. Training sets teams up for long-term success.

Define KPIs to measure implementation success. Clear metrics ensure you can track progress, demonstrate value, and refine the rollout over time.

Overlooking integration with ERP/BI systems. Reporting tools only reach their full potential when they connect seamlessly with existing financial and analytics platforms. Integration should be a priority, not an afterthought.

Insufficient training and change management planning. Without proper support, teams may struggle to adopt new processes, reducing the effectiveness of the entire implementation.

Neglecting to plan for ongoing support or updates. Reporting needs evolve, and systems require maintenance. A lack of long-term planning can undermine sustainability and user confidence.

By addressing these factors proactively, organisations can avoid disruption and maximise the value of their reporting investments.

Corporate reporting software supports organisations in meeting diverse stakeholder needs — from regulatory compliance to clear, effective communication. Streamlining the reporting process is essential to ensure secure, transparent and consistent reporting, regardless of industry, size, or organisational structure.

FAQs

What is corporate reporting software?

A cloud-based SaaS platform, such as CtrlPrint, that automates and streamlines the preparation, management, and publication of financial and regulatory reports.

How does it improve compliance?

By ensuring regulatory formats, creating automated audit trails, and reducing manual error.

Can it integrate with my ERP?

Yes – leading solutions, like CtrlPrint, integrate with ERP and BI systems, ensuring data integrity across platforms.

Is cloud deployment secure?

Modern cloud applications use advanced encryption and security frameworks. CtrlPrint, for example, is ISO 27001 certified and SOC 1 Type 1 & Type 2 compliant.

Next steps

To understand broader regulatory standards, visit ESMA – European Single Electronic Format and XBRL International.

For years, the phrase "internal controls" lived deep within audit committee papers, while "digital tagging" was viewed as a technical after-thought...

For corporate reporting leaders, the annual sustainability report is the ultimate balancing act: you are juggling rigorous ESG data and the need to...

The short answer: Ideally, your sustainability report should be published simultaneously with your Annual Report. For most companies with a December...

For executives, the challenge is clear: which tools offer the automation, compliance, and collaboration needed to keep pace? With a growing market of...

Modern reporting solutions, such as CtrlPrint, are built to help organisations navigate this shift. By combining automation, integration, and...