UKSEF and provision 29: preparing for the 2026 reporting shift

For years, the phrase "internal controls" lived deep within audit committee papers, while "digital tagging" was viewed as a technical after-thought...

5 min read

CtrlPrint : Updated on December 8, 2025

PDF reporting only has been a thing of the past, and companies now follow the latest ESEF regulations: this financial reporting ensures transparency and accessibility of financial information to the stakeholders.

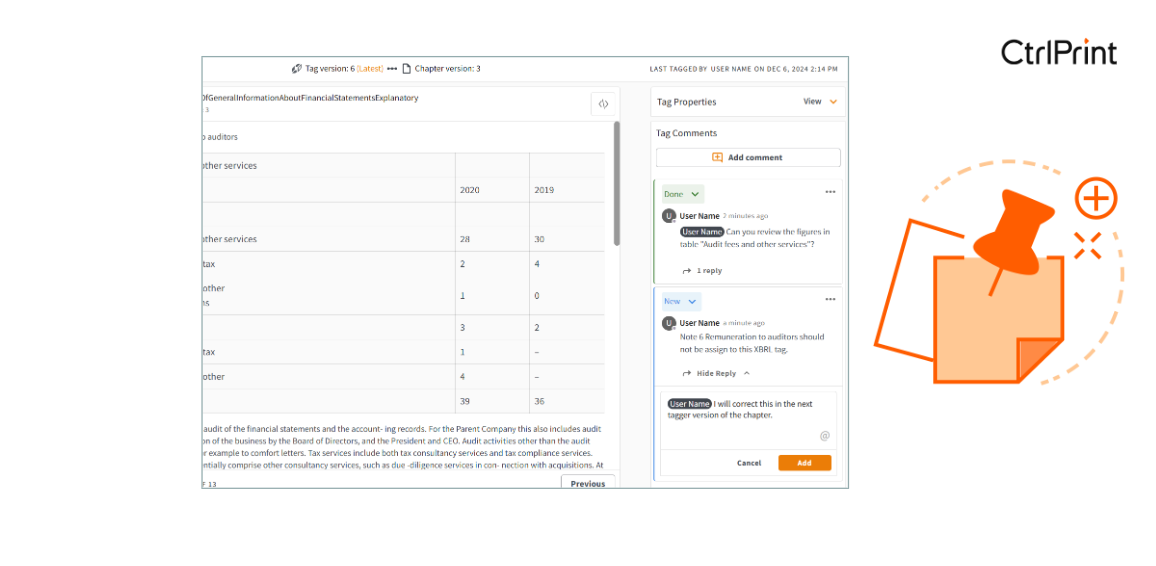

The listed companies must prepare and submit their financial reports in this digital format, which is both human-readable and machine-readable. You can achieve this with the CtrlPrint XBRL-certified software for financial & sustainability tagging. In this article, we will shed some light on ESEF, and answer questions such as: what is ESEF taxonomy, what is ESEF tagging, who has to comply with ESEF, and more.

Before we begin, if you are in need of a corporate reporting software to submit your ESEF reports, check how CtrlPrint can help you deliver compliant and captivating reports now.

Annual financial reports must be submitted in a specific digital format to meet the ESEF reporting requirements.

ESEF reporting improves three main factors in the financial data: transparency, accessibility, and comparability.

Understanding the ESEF reporting can be overwhelming since there are many aspects to this reporting method, so here is a quick overview to help you understand it better:

The ESEF mandate, set by ESMA, requires the EU-regulated market issuers to prepare annual financial reports using the ESEF format. The standard format makes reports both machine-readable and more accessible.

ESEF tagging involves organising financial data according to the ESEF taxonomy derived from the IFRS taxonomy. There are two main steps of the IXBRL tagging process for ESEF.

Tagging primary financial statements: this is the detailed tagging of main financial statements such as income statements and balance sheets.

Block tagging of notes: this involves tagging of larger pieces of text and tables as a whole, rather than individual data points.

Block tagging is the application of iXBRL tags to notes and accounting policies.

As explained above, in block tagging one has to tag the entire sections of that text. It does not involve tagging every piece of financial data as in the case of tagging primary financial statements.

The use of the ESEF taxonomy standardises financial reports and enables comparability across companies in Europe. It relies on a digital language known as XBRL. ESEF taxonomy streamlines the company’s financial reports, reducing manual error and enhancing data accuracy.

The entire process results in financial statements that are consistent, easily readable, and comparable, making it easy for investors, regulators, and other stakeholders to analyse the financial position of the companies.

The ESEF taxonomy comes in various languages to fulfil the needs of different European Countries.

From January 2020, every company with securities in the European Union has to publish their financial reports in digital format for fiscal years beginning on or after 1 January, to meet the guidelines of ESMA. So, companies with securities listed on the market in the EU, such as Euronext, must comply with ESEF.

It is mandatory for several reasons, let's see the main ones;

The companies can use the ESEF taxonomy, and ESEF reporting software and solutions to comply with the ESMA’s requirements. The inability to comply with the rules might result in penalties or other reputational damages.

Here is a checklist to help you ensure your financial reports are according to the ESEF standards in 2024;

If you’re wondering what the differences are between the previous PDF reporting and ESEF-compliant XHTML reports, we broke it down for you in the below table.

|

Aspect |

PDF Report |

ESEF (XHTML) Report |

|---|---|---|

|

File format |

It is a static format with easy reading and distribution. |

It has a machine-readable and a human-readable format. |

|

Data tagging |

No data tagging; information is visually presented but not easily extractable. |

Financial data tagged with XBRL is easy to extract and analyse. |

|

Regulatory compliance |

Historically accepted for legal filings but not compliant with ESEF requirements. |

Mandatory format for ESEF filings, ensuring compliance with European financial reporting standards. |

Financial specialists might have a responsibility to learn new skills in the field after the advent of ESEF. Unless their company decide to hire consultants to comply with ESEF reporting, they must know how the software works in preparation for XHTML reports and the tagging using iXBRL.

We would recommend seeing this as a learning opportunity as they need to ensure the accuracy of tagging and comply with the rules of the financial reports.

Moreover, the preparation of digital reports results in reduced human errors, and it can also be beneficial in saving time. Financial specialists could then invest the saved time in the most analytical aspects of the financial reports.

Using the right software is also beneficial to make this process as smooth and efficient as possible. At CtrlPrint, with more than 25 years of experience in corporate and financial reporting, we have developed great tools to aid you with your ESEF reports and more. Contact us today to access our demo or get in touch with our support team and the corporate reports experts at CtrlPrint!

Auditors must verify that the client’s financial reports comply with ESEF requirements. They can do this by using a digital tool to review the XBRL report and verify that there are no errors, calculation inconsistencies or hidden tags in the final report.

Additionally, the auditors need to be technically proficient in order to work with XHTML and XBRL to navigate and interpret ESEF reports.

Now that you know how essential the ESEF taxonomy is in standardising financial statements, we hope you’ll be ready to submit a compliant report, keeping your business safe from severe penalties.

Complying with ESEF also helps companies enhance data accuracy and transparency, therefore it is fundamental for companies to keep themselves updated with the evolving taxonomy, and use the right corporate software for their ESEF reports. If you’re still looking for the ideal reporting software, check how CtrlPrint can help you be compliant with ESEF, and other regulatory requirements such as CSRD and more.

For years, the phrase "internal controls" lived deep within audit committee papers, while "digital tagging" was viewed as a technical after-thought...

For corporate reporting leaders, the annual sustainability report is the ultimate balancing act: you are juggling rigorous ESG data and the need to...

The short answer: Ideally, your sustainability report should be published simultaneously with your Annual Report. For most companies with a December...

[wistia_video]

ESMA has released the updated ESEF Reporting Manual for year 2025 reporting. The latest edition introduces a few clarifications and tighter...