How to prevent greenwashing in corporate reporting

The end of the "eco-friendly" era in corporate reporting For the better part of a decade, corporate sustainability reporting often followed a...

2 min read

Agnes Sundblad : Updated on January 13, 2026

Artificial Intelligence is moving from experimentation to operational use in corporate reporting functions. Rather than replacing professional judgement, AI is increasingly embedded in specific stages of the reporting lifecycle – from data validation and consolidation to narrative drafting and analytical review.

For CFOs, Chief Accounting Officers, and sustainability leaders, the central question is no longer whether AI can improve efficiency, but how it can be deployed without compromising control, auditability, or regulatory compliance.

One of the most promising benefits is speed. As AI tools evolve, they have the potential to process large volumes of data more efficiently, assist with reconciliations, and help identify anomalies before reports are published. In corporate reporting, where precision is critical, these capabilities are still emerging and require careful validation.

For these reasons, in practice, AI’s strongest impact is currently seen in the pre-close and close-adjacent phases of reporting. Machine-learning models can assist with data validation, identify inconsistencies across entity submissions, and flag unusual movements earlier in the close cycle.

Instead of manually checking spreadsheets or consolidating figures across subsidiaries, reporting teams can focus on analysis and interpretation. The result is faster reporting cycles and earlier insights for decision‑makers. This also shifts finance teams away from late-stage error correction toward earlier analytical review, reducing close pressure without weakening control environments. However, these applications remain decision-support tools and require defined escalation and approval thresholds.

.png?width=2752&height=1536&name=Group%202%20(1).png)

Generative AI is increasingly applied to narrative-heavy sections of annual and sustainability reports, such as management commentary, policy disclosures, and methodology explanations. When trained on approved source material and reporting frameworks, these tools can improve linguistic consistency and reduce drafting effort.

However, leading organisations restrict generative AI to assisted drafting, with final accountability remaining firmly with management. The credibility of financial and ESG disclosures depends not on automation, but on clear traceability between source data, narrative claims, and sign-off responsibility.

From a risk and compliance perspective, AI introduces both opportunity and obligation. Advanced analytics can enhance control monitoring by identifying anomalies and emerging risk patterns across large transaction volumes. At the same time, regulators and auditors increasingly expect transparency around model logic, data inputs, and decision thresholds.

For multinational groups reporting under IFRS, local GAAP, and emerging sustainability standards, this places model governance alongside traditional internal controls. This can significantly reduce the complexity of working across multiple jurisdictions, making compliance proactive instead of reactive. However, to guarantee accuracy, AI outputs must be explainable, reviewable, and defensible under audit scrutiny.

For investors, AI‑enhanced reporting could provide quicker access to key performance data and make it easier to compare results across regions or portfolios. For executives, AI can support real‑time dashboards and faster scenario analysis, helping ensure strategic discussions are built on current, consistent insights.

In this way, technology is more than a reporting tool – it becomes a foundation for better decision‑making and governance.

To summarize: for finance and sustainability leaders, AI in corporate reporting is not a technology initiative but a governance decision. Organisations that succeed will be those that integrate AI into controlled reporting workflows, clearly define accountability, and engage auditors early.

Used responsibly, AI can shorten reporting cycles, improve insight quality, and strengthen stakeholder confidence. Used carelessly, it risks undermining trust in the very disclosures it aims to improve.

At CtrlPrint, we see AI as a critical element in the future of financial reporting. While we research how best to integrate AI into our reporting platform and maintain high data security, our solutions are designed to combine automation with collaboration, ensuring reports are accurate, efficient, and aligned with stakeholder expectations.

The result: faster processes, stronger quality, and reporting that reflects both today’s demands and tomorrow’s opportunities.

The end of the "eco-friendly" era in corporate reporting For the better part of a decade, corporate sustainability reporting often followed a...

.jpg)

The initial hype surrounding artificial intelligence in corporate finance has settled. We have moved past the "wow" phase of generative text and are...

For years, the phrase "internal controls" lived deep within audit committee papers, while "digital tagging" was viewed as a technical after-thought...

.jpg)

The initial hype surrounding artificial intelligence in corporate finance has settled. We have moved past the "wow" phase of generative text and are...

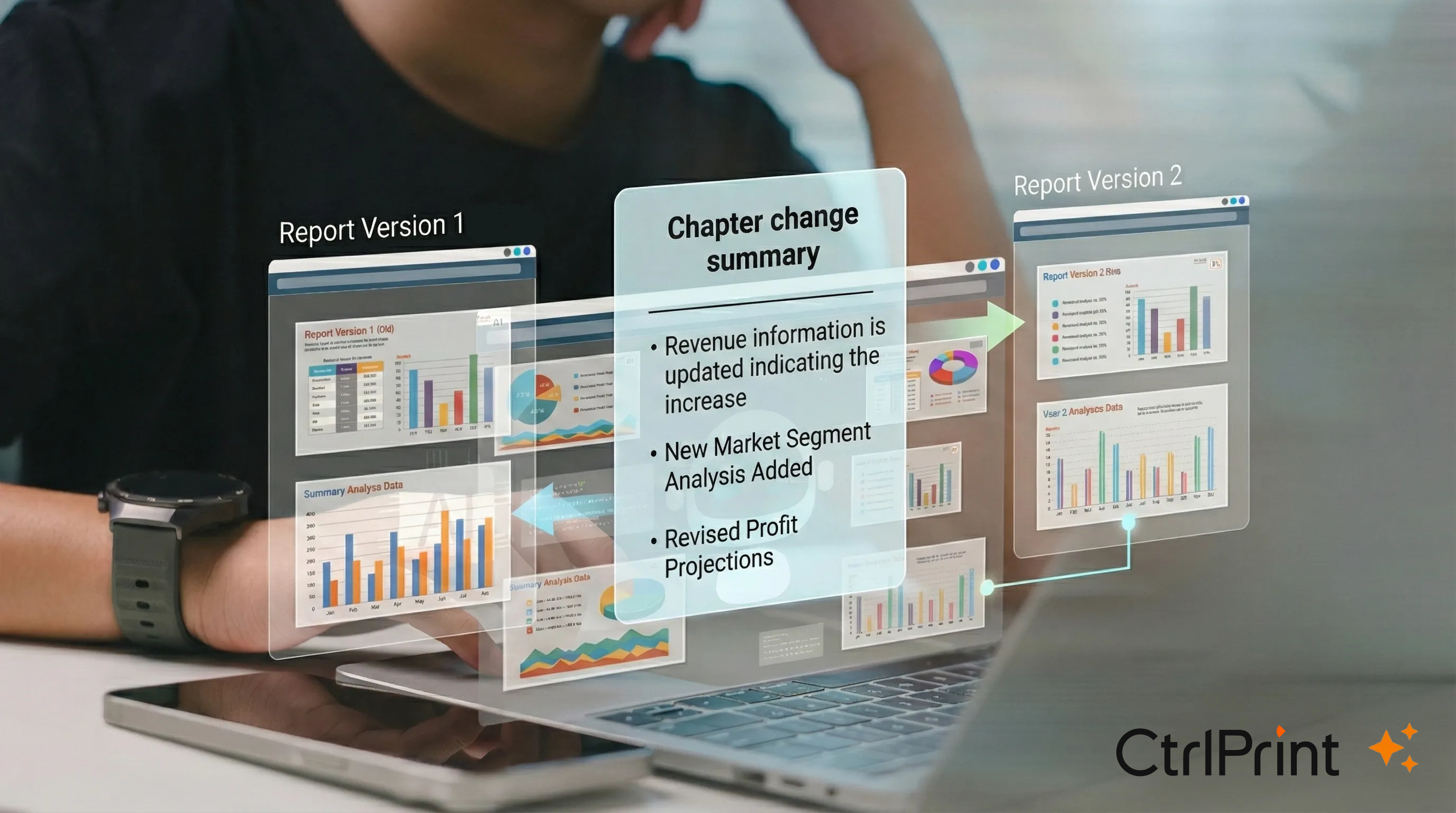

Reviewing the changes between versions can take up considerable time. Version number has changed, but what is actually new? Keeping track of progress...

The short answer: Ideally, your sustainability report should be published simultaneously with your Annual Report. For most companies with a December...